Engineering & Construction

Connect project costs, payments, and reporting with streamlined finance tech.

In today’s fast-moving digital economy, finance teams often struggle with disconnected systems, manual processes, and outdated tools that slow down decision-making and increase compliance risks.

At Future Unite, we provide financial technology consulting and system integration services to businesses across the UK and London. From choosing the right accounting software to building custom dashboards and integrating complex systems, we enable finance functions to work smarter, not harder. Our expertise ensures accuracy, speed, and clarity across your entire financial operation.

How We Make an Impact

Whether you’re looking to optimise existing systems or explore new financial technology, book a consultation to discover the right solution for your business.

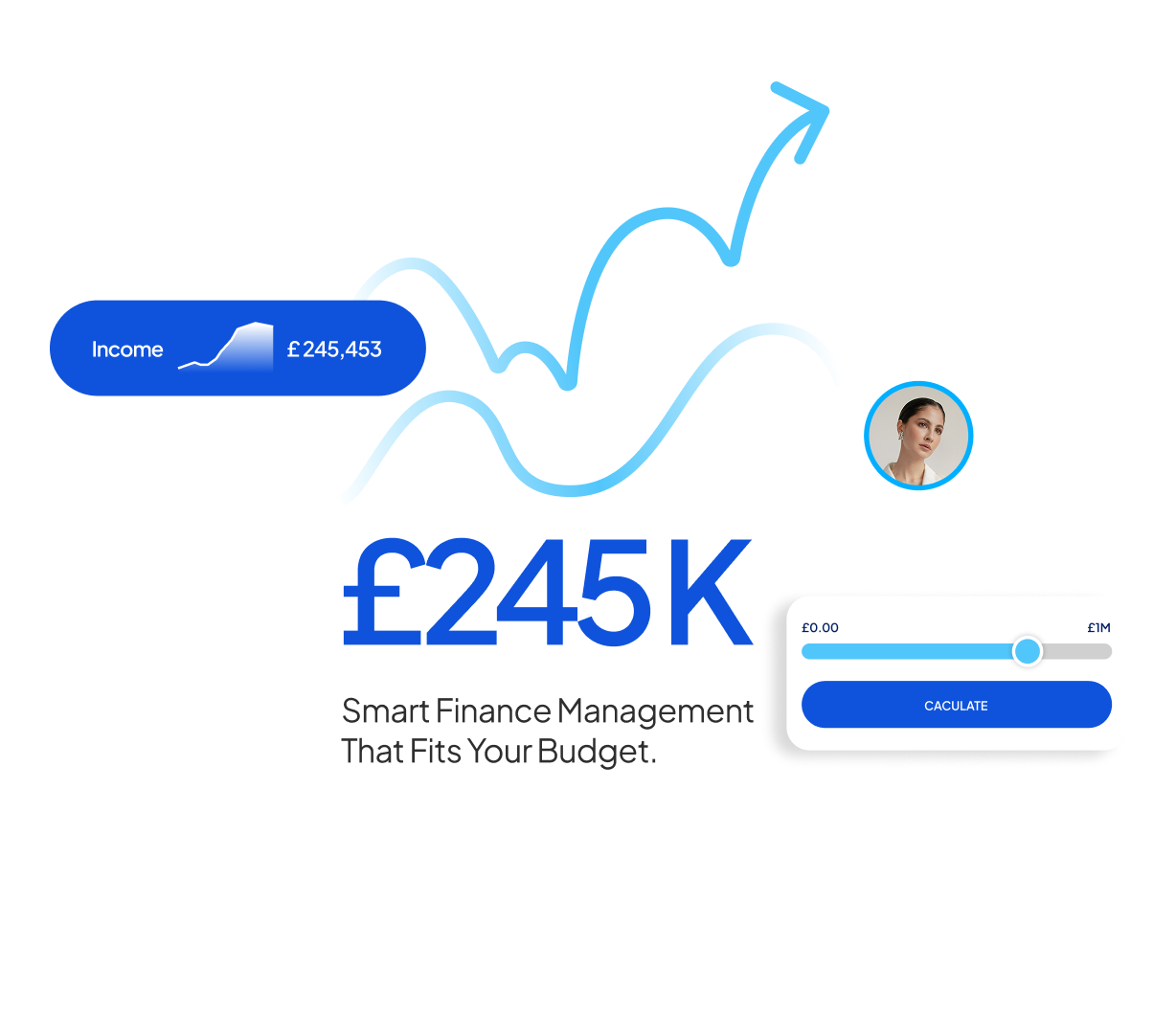

Our financial technology services are specially designed for UK businesses to streamline finance operations, improve reporting accuracy, and support smarter decision-making at scale.

Get expert guidance on choosing the right accounting or finance software tailored to your business needs.

We build custom fintech tools and platforms to support your finance operations and business goals.

Set up visual dashboards that show real-time financial data, KPIs, and reporting in one place.

Connect your finance tools and platforms for seamless data flow across your systems.

Automate routine finance tasks like invoicing, approvals, and reporting to save time and reduce errors.

Enhance your existing systems with purpose-built features that meet specific finance requirements.

Ensure your financial data stays accurate and in sync across platforms with structured backend setup.

Get continuous support for your financial systems to keep everything running smoothly and securely.

We work with businesses across diverse sectors to deliver technology-led finance solutions tailored to their operational needs. We step in to modernise financial systems and enhance performance where it matters most.

Connect project costs, payments, and reporting with streamlined finance tech.

Automate payroll, billing, and contractor payments with smart systems.

Integrate tools and track cash flow with real-time finance dashboards.

Simplify financial workflows and improve visibility across services.

Unify sales, inventory, and accounts with connected finance platforms.

Track budgets, automate invoicing, and forecast project cash flow with ease.

Limited slots available — secure yours early.

We start by learning about your business needs, challenges, and goals through a one-to-one consultation.

We prepare a customised scope of services with a clear pricing structure to match your requirements.

Once approved, we guide you through a smooth onboarding process and prepare everything to get started.

Our dedicated team begins delivering the service with clear communication, timelines, and ongoing support.

Our services cover everything from software selection and system integrations to dashboard setup, process automation, and ongoing technical support. We tailor each solution based on your business structure, goals, and existing tech stack.

Yes — we specialise in working with popular platforms like Xero, QuickBooks, Sage, and industry-specific tools. We also build custom add-ons or integrate third-party apps to extend your existing systems.

Absolutely. We create real-time dashboards that visualise key financial data like cash flow, budgeting, KPIs, and forecasts — making reporting easier and decision-making faster.

Our solutions are scalable. We work with startups, SMEs, and growing businesses across the UK, offering the right level of tech and support based on your stage and complexity.

It depends on the scope, but most projects range from 2 to 12 weeks. We start with a consultation and provide a clear project timeline once we define the technical and operational requirements.

Do not wait to adapt what others already have.