Engineering & Construction

Track expenses, invoices, and payments accurately while staying compliant with CIS rules.

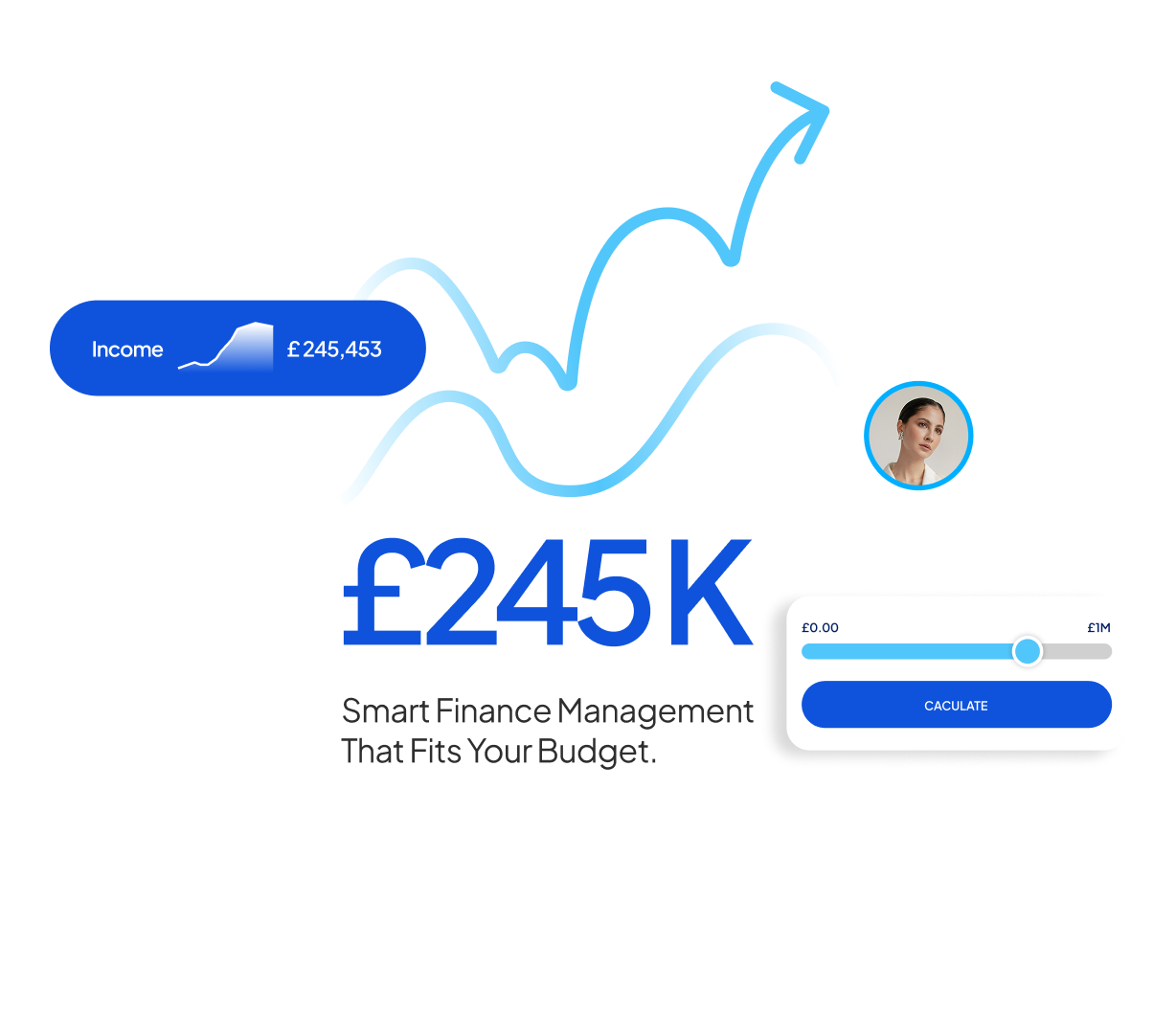

Keeping your financial records in order is not just good practice — it is essential for running a smooth and compliant business. Without proper bookkeeping and oversight, companies often face cash flow gaps, missed tax deadlines, and poor financial visibility that can affect everyday decisions and long-term growth.

That’s where Future Unite comes in. We provide dependable Bookkeeping & Compliance services for small and growing businesses across London and the UK. With an experienced team of accountants and flexible support tailored to your needs, we take the pressure off your finance admin. From maintaining accurate records to managing VAT filings and reconciliations, we help you stay organised and ready to move forward with complete confidence in your numbers.

How We Make an Impact

We understand that every business faces unique challenges when it comes to Bookkeeping and Compliances. We are here to help solve them for you. Get in touch to request a quote or book a free one-to-one consultation today.

We provide expert-led bookkeeping support tailored to meet the day-to-day demands of UK businesses. Whether you need help staying compliant or keeping your records in order, we are here to make it simple, reliable, and stress-free — and always ready to adapt to what your business needs.

Ensure timely and accurate VAT filings while staying compliant with HMRC regulations and avoiding penalties.

Get a clear financial picture every quarter with professionally prepared management accounts to support better decision-making.

Keep your financial records accurate and up to date by reconciling transactions across your bank and credit card accounts.

Track what you owe and what you're owed with organised accounts payable and receivable processes that improve cash flow

Gain visibility into your upcoming cash position to make informed planning decisions and prevent shortfalls.

Maintain accurate general ledger and journal entries that form the backbone of compliant, reliable financial reporting.

Let us handle HMRC communication for PAYE or VAT matters to ensure smooth compliance and peace of mind.

Be fully prepared for audits with all necessary reports, records, and schedules presented in a professional format.

We work with businesses across diverse sectors to deliver bookkeeping and compliance services tailored to their day-to-day operational needs. Our goal is to simplify financial workflows and keep your business on track.

Track expenses, invoices, and payments accurately while staying compliant with CIS rules.

Manage contractor timesheets, payments, and VAT with error-free, real-time bookkeeping.

Streamline income, expenses, and recurring billing with scalable bookkeeping tools.

Ensure HMRC compliance and stay on top of expense claims and supplier payments.

Maintain accurate records across online and physical stores with reconciled sales data.

Handle project-based billing, supplier payments, and financial compliance with ease.

Limited slots available — secure yours early.

We start by learning about your business needs, challenges, and goals through a one-to-one consultation.

We prepare a customised scope of services with a clear pricing structure to match your requirements.

Once approved, we guide you through a smooth onboarding process and prepare everything to get started.

Our dedicated team begins delivering the service with clear communication, timelines, and ongoing support.

Bookkeeping focuses on recording daily financial transactions like invoices, receipts, and bank entries, while accounting analyses this data to provide financial reports, file taxes, and guide decisions. At Future Unite, we ensure your bookkeeping lays a strong foundation for financial accuracy and compliance.

Ideally, bookkeeping should be maintained weekly or monthly to avoid backlogs, errors, and missed deadlines for VAT and payroll. Regular updates also help you track cash flow and prepare for HMRC reporting.

Yes. While accounting software helps automate tasks, you still need an expert to set it up correctly, monitor entries, reconcile accounts, and ensure HMRC compliance. Future Unite supports both software management and manual oversight.

Absolutely. We keep your records audit-ready with well-organised ledgers, VAT filings, and supporting documents. In case of an inspection, we assist in compiling reports and answering queries.

UK law requires businesses to retain financial records for at least 6 years. These include invoices, receipts, bank statements, and VAT documents. We help you maintain these securely and in line with HMRC expectations.

Do not wait to adapt what others already have.