Engineering & Construction

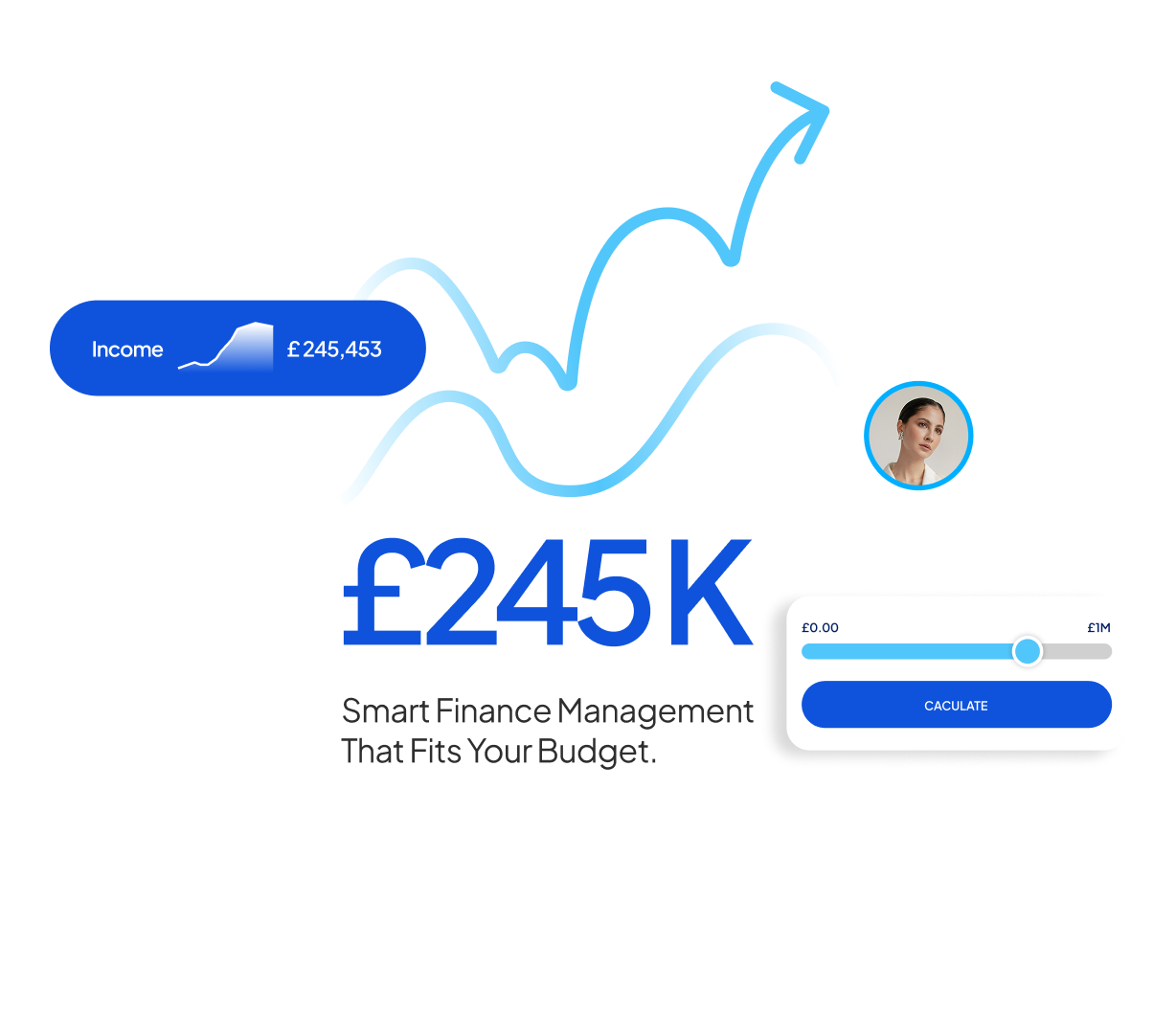

Forecast cash needs and model project timelines for better financial planning.

Planning for the future without reliable financial insight can expose your business to risk. Many companies operate with outdated budgets, vague forecasts, or disconnected spreadsheets — making it hard to align strategy with financial reality.

At Future Unite, we provide Strategic Financial Planning & Analysis and Modelling services for growing businesses across London and the UK. From building robust cash flow models to delivering forward-looking forecasts and performance insights, we help you prepare for what’s next with clarity. Our team works closely with you to understand your goals, align numbers to strategy, and support smarter budgeting, investment decisions, and scenario planning. Whether you’re scaling operations, preparing for funding, or looking to improve cost control, we give you the tools and financial foresight to grow.

How We Make an Impact

No two businesses face the same issues when it comes to Financial Planing and Analysis. Let us understand yours and help you move forward. Contact us for a custom quote or book your free consultation.

We provide forward-looking FP&A support to help businesses plan with clarity and confidence. Whether it’s budgeting, forecasting, or scenario modelling — we tailor everything to your specific goals and decision-making needs.

Get expert support to align your finances with long-term goals and make smarter business decisions.

Build reliable budgets and forward-looking forecasts to stay on track and plan ahead with confidence.

Monitor and manage your cash flow to avoid shortfalls, maintain stability, and support growth.

Understand what’s driving your results with tailored insights that help you improve performance.

Know exactly when your business becomes profitable — and what it takes to get there faster.

Stay in control of spending with clear analysis of where costs differ from plan and why.

Track key metrics that matter to your business and make sure performance stays on target.

We build dynamic Excel models tailored to your business — from scenario planning to financial projections.

We collaborate with businesses from different sectors to deliver strategic financial planning, forecasting, and modelling services tailored to their unique goals. We focus on supporting better decisions and stronger financial direction.

Forecast cash needs and model project timelines for better financial planning.

Plan revenue targets, hiring budgets, and headcount profitability scenarios.

Create growth forecasts and runway models for investment and scaling.

Project income, costs, and growth across services and locations.

Forecast seasonal performance and simulate pricing or inventory decisions.

Model cash flow by campaign, team costs, and long-term profitability.

Limited slots available — secure yours early.

We start by learning about your business needs, challenges, and goals through a one-to-one consultation.

We prepare a customised scope of services with a clear pricing structure to match your requirements.

Once approved, we guide you through a smooth onboarding process and prepare everything to get started.

Our dedicated team begins delivering the service with clear communication, timelines, and ongoing support.

FP&A covers budgeting, forecasting, cash flow planning, and scenario modelling. It gives you the tools to predict and prepare for financial outcomes, manage growth, and make confident investment decisions.

Yes. We work with your team to build a realistic budget aligned with your business goals. We consider revenue projections, costs, seasonal trends, and economic factors relevant to your industry.

Yes. We offer short-term and long-term cash flow forecasting, helping you avoid cash shortfalls, manage debt, and plan investments. It’s essential for maintaining financial control in uncertain market conditions.

Financial modelling simulates your business’s future based on real data and assumptions. It’s crucial when raising funds, launching new products, or planning for expansion. We build clear, Excel-based models for better financial decisions.

It’s useful for any business that wants to improve planning and control. We simplify FP&A tools for SMEs — making them easy to use, insightful, and tailored to your business size and goals.

Do not wait to adapt what others already have.