Engineering & Construction

Monitor job-level costs and profitability with real-time financial reports.

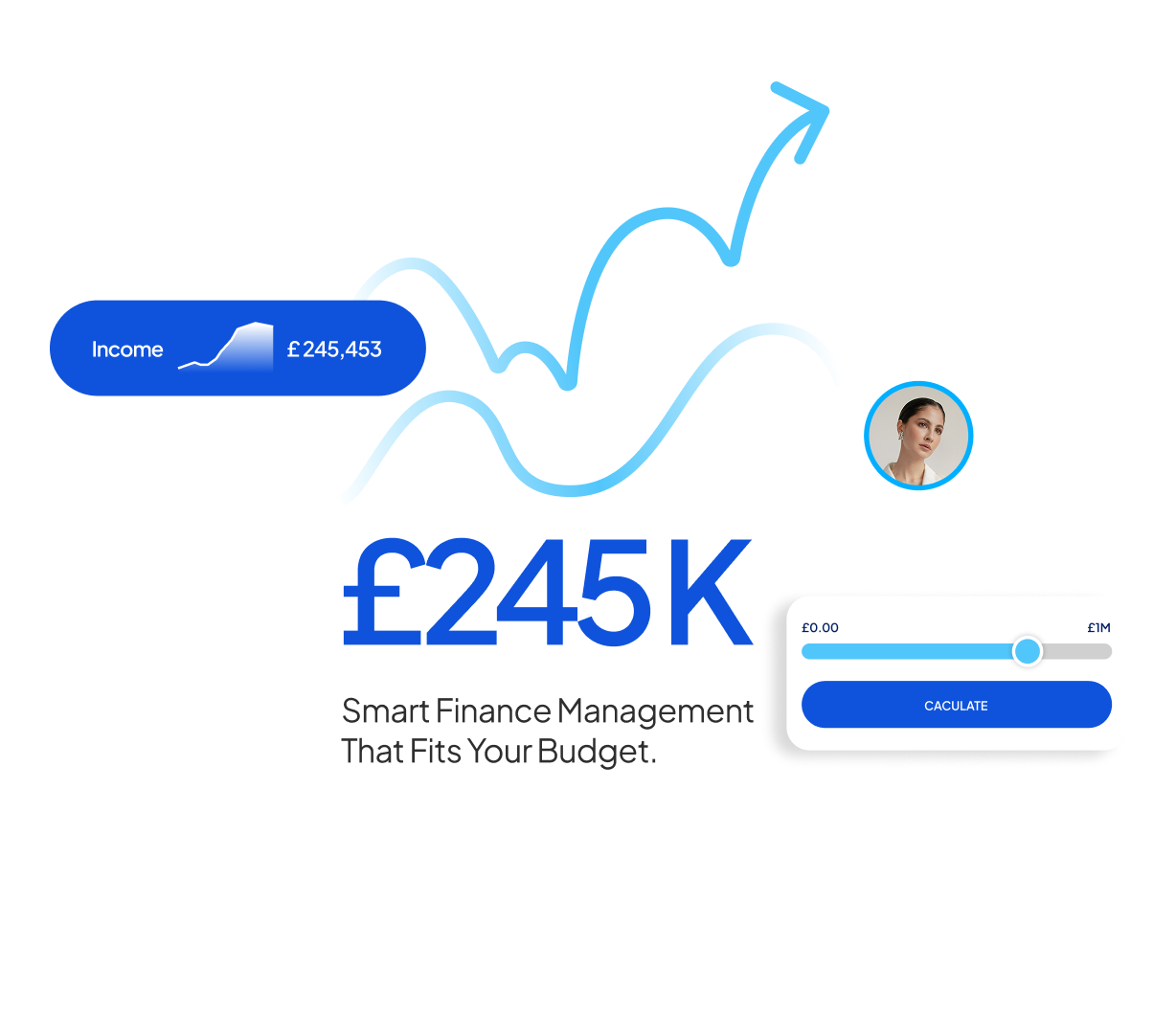

As businesses grow, financial complexity increases — and so does the need for clear, actionable insight. Without structured management accounting, leadership teams often face blurred visibility into costs, cash flow, and performance, making strategic decisions more difficult and risk-prone.

At Future Unite, we specialise in Management Accounting services designed for SMEs and scaling businesses across London and the UK. We go beyond basic reporting — delivering tailored monthly reports, variance analysis, cost centre tracking, and board-level insights that drive clarity and accountability. Whether you are preparing for growth, managing multiple departments, or reporting to stakeholders, our support helps you stay in control of your finances.

How We Make an Impact

Struggling with Management Accounting in your business? You are not alone — and we are here to help. Reach out now for a personalised quote or book a free one-on-one session.

We offer insightful, professional management accounting support for businesses seeking better financial visibility. Our reporting solutions are tailored to what matters most to your leadership — and we are always open to aligning with your internal requirements.

Get monthly financial reports that show how your business is performing — simple, clear, and decision-ready.

Spot financial differences early by comparing actual results with your budgets and forecasts.

View performance by department and receive ready-to-use reports for board meetings and reviews.

Track your most important business metrics in one place and stay on top of what really matters.

See where your profits are coming from — and where you might be losing money.

Keep your cash flow healthy with regular updates on money in, money out, and what’s coming next.

Put the right checks in place to reduce risk, avoid errors, and meet compliance requirements.

Work alongside financial experts who help you understand the numbers and plan for growth.

We work with growing businesses across various industries to provide management accounting that fits their reporting and performance needs. Our insights help decision-makers improve control and plan ahead.

Monitor job-level costs and profitability with real-time financial reports.

Track placement margins, recruiter performance, and monthly profitability.

Gain insight into recurring revenue, cost allocations, and operational KPIs

Get clear visibility into departmental finances, performance, and growth.

Understand product margins, regional performance, and campaign results.

Assess account profitability, track resource costs, and measure ROI.

Limited slots available — secure yours early.

We start by learning about your business needs, challenges, and goals through a one-to-one consultation.

We prepare a customised scope of services with a clear pricing structure to match your requirements.

Once approved, we guide you through a smooth onboarding process and prepare everything to get started.

Our dedicated team begins delivering the service with clear communication, timelines, and ongoing support.

Management accounting provides internal financial insights to support decision-making. It includes cash flow analysis, KPI tracking, and variance analysis. Unlike financial accounting, which is for external reporting, this helps managers make informed business decisions.

Monthly reports are ideal for most growing businesses, but we can customise this based on your needs — quarterly, bi-weekly, or based on board meeting schedules.

CEOs, CFOs, directors, and department heads benefit from timely management reports that highlight profitability, cost trends, and risks. It’s particularly valuable for scaling SMEs, investor-backed startups, and businesses with multiple cost centres.

Yes. We prepare board packs, performance dashboards, and tailored reports that highlight metrics that matter most to your leadership team. Visual, insightful, and decision-ready.

Absolutely. Through cost centre reporting and variance analysis, we identify areas where you’re overspending and suggest practical steps to improve margins and operational efficiency.

Do not wait to adapt what others already have.