Engineering & Construction

Process complex pay runs with CIS, subcontractor payments, and site allowances.

Running payroll is not just about paying your team — it requires careful handling of HMRC compliance, pension enrolment, statutory pay, and reporting responsibilities. For many growing businesses, these tasks quickly become complex and time-consuming, and even small errors can lead to fines or loss of employee trust.

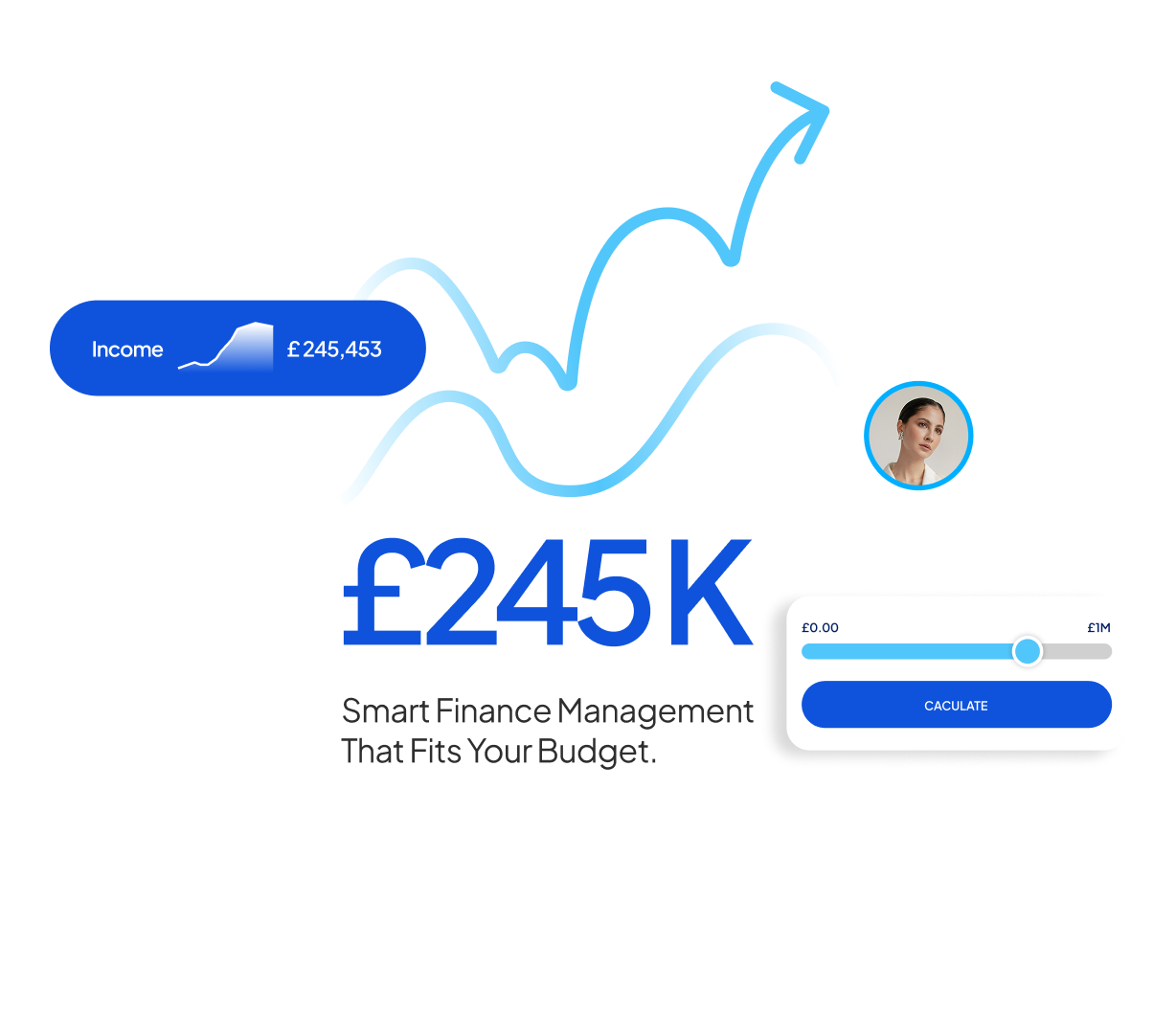

At Future Unite, we offer reliable Payroll Management services for businesses across London and the UK. Whether you have a small team or a growing workforce, we handle everything from RTI submissions and pension contributions to digital payslips and year-end reporting. With our expert support, you can stay compliant, pay staff on time, and meet your employer obligations effortlessly.

How We Make an Impact

Your business is different — so are your challenges around Payroll Management. Let’s work together to find the right solution. Request a tailored quote or schedule a free consultation to begin.

We deliver accurate, timely payroll support tailored to the real needs of employers. Whether you have a few staff or a growing team, we are here to ensure things run smoothly — and we are happy to customise our support based on how your business operates.

Ensure your employees are paid accurately and on time every month with stress-free payroll management.

We handle all Real Time Information (RTI) filings, keeping your business compliant with HMRC rules.

Provide secure, easy-to-access digital payslips to your staff with every payroll run.

Manage pension duties with ease — from enrolment to ongoing contributions and compliance.

We calculate and process statutory payments correctly so you stay compliant and employees are supported.

Get all required documents generated and submitted on time, with zero hassle at year-end.

Stay HMRC-compliant with Construction Industry Scheme payroll for subcontractors and contractors.

Maintain accurate, audit-ready payroll records — securely stored and fully accessible when needed.

We support companies across key industries by delivering payroll services that fit the way they operate. From handling compliance to improving payroll accuracy, we help make your payroll stress-free and reliable where it counts.

Process complex pay runs with CIS, subcontractor payments, and site allowances.

Automate PAYE, pensions, and contractor pay with multi-schedule payroll systems.

Support hybrid teams with accurate salary, bonus, and benefits administration.

Ensure accurate pay for clinical and admin teams with statutory compliance.

Manage payroll for shift workers, part-time roles, and seasonal staff with ease.

Handle regular payroll and freelance payments in one integrated process.

Limited slots available — secure yours early.

We start by learning about your business needs, challenges, and goals through a one-to-one consultation.

We prepare a customised scope of services with a clear pricing structure to match your requirements.

Once approved, we guide you through a smooth onboarding process and prepare everything to get started.

Our dedicated team begins delivering the service with clear communication, timelines, and ongoing support.

Our payroll service includes RTI submissions to HMRC, payslip generation, pension auto-enrolment, statutory pay calculations (SSP, SMP, etc.), CIS payroll, year-end reporting, and full compliance management for your business.

We stay updated with HMRC rules, automatically apply thresholds, statutory pay rates, and ensure accurate submissions via RTI. We also support you during audits or HMRC reviews, reducing legal and financial risks.

Yes. We provide CIS payroll services including monthly deductions, subcontractor verification, and reporting. We make sure you meet your obligations as a contractor under the Construction Industry Scheme.

We offer both, depending on your preference. Most UK businesses run monthly payroll, but we can tailor schedules to suit your workforce and ensure everyone is paid on time.

We primarily focus on UK-based payroll, but we can help advise on compliant payroll processes for remote teams or connect with international specialists if needed.

Do not wait to adapt what others already have.